VectorVest Founder, Dr. Bart DiLiddo has always said that WatchLists are one of the most powerful tools within the VectorVest program. It’s not only a great way to manage the stocks that you own, it’s also a valuable tool to keep track of stocks that you might like to buy.

December was a difficult, bearish month. Not a time for buying, but a great time to fine-tune your trading plan, study stocks and prepare for the sustained uptrend that inevitably comes. Maintaining a list of the best stocks in a WatchList is a terrific way to get ready.

Why use WatchLists? One of the best analogies I’ve heard is that it’s like buying groceries. Have you ever been to the supermarket without a shopping list? If yes, then I’m sure you can relate to the two most likely outcomes:

- You forget a few items that you intended to buy. Perhaps you’ve been waiting for them to go on sale. Today was the day, but you missed it because you didn’t have your list. A costly mistake.

- You start impulse buying. You add to your cart products that you never intended to buy. They don’t suit your needs, they’re overpriced, or they’re in the wrong seasonal group and won’t taste good. Wasteful, and costly.

Neither of these scenarios is favourable to you as the buyer. Avoiding those mistakes in stock investing is a good reason to keep a WatchList of stocks that you have already studied. They meet your criteria. You’re just waiting for a good time to buy when market conditions are favourable and the stock is in your ‘buy zone’ and rising in price.

THE MASTER RETIREMENT WATCHLIST

VectorVest maintains several WatchLists for subscribers, the newest of which is the Master Retirement WatchList, located in the Special WatchLists folder. It’s ideal for investors who only want to invest in stocks that are among the best in terms of safety, growth or dividends, or a combination. The WatchList was created for our new, widely praised CA Investing For Retirement course. Dr. DiLiddo suggested we update the list every week and make it available to all subscribers.

The method for creating the list was revealed by Mr. Jim Penna, Manager of Retirement Services, in a SOTW video July 2, 2015 titled, “5 Top Retirement Strategies”. For our list, we run eight of our top retirement-focused searches every Monday, adding the top 10 stocks from each to the Master Retirement WatchList. Each week there is the potential for 80 new stocks, but, of course, there are duplicates and in bearish market conditions such as we’ve seen recently, not every search finds 10 stocks that meet the criteria. Since we began in early December, the list has held between 18 and 24 stocks. I expect those numbers will grow as we see more green lights in the Color Guard and eventually a Confirmed Up Call.

All the searches require a high Relative Safety, RS, either by the Sort or in the search criteria. There are subtle differences in each search, creating a diversified WatchList overall. A few require dividends while others focus on growth, higher minimum price, high earnings growth or high VST. Once the stocks are in the WatchList, the default Sort is VST, but of course you can change it to any other indicator or combination that suits your investment style. Then study the graphs.

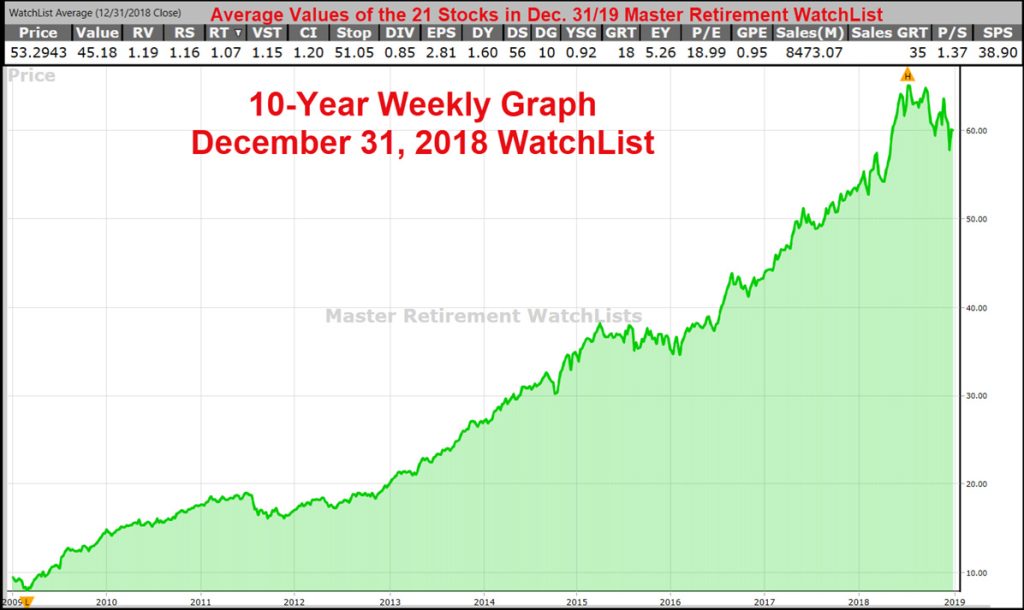

A good test of the quality of stocks in the Master Retirement WatchList is to study the WatchList Average Values displayed in the bottom row of the WatchList. As of Monday, December 31st, the 21 stocks in the list have an average RV, RS, RT, VST and CI all above 1.00. Perhaps most important for retirement-minded investors, the average RS is a robust 1.16. Next, right click on the WatchList Average row and choose View WatchList Average Graph. Notice on a 1-year daily graph that price is clearly up from bottom left to the right edge. In fact, a QuickTest shows an average gain in 2018 of 21.48% with only two losers. The equity curves of the 5-year and 10-year weekly graphs look exactly like we all would wish our portfolios to look like. None of the above accounts for dividends received.

So, when you’re considering a list of stocks to buy, or just looking for a few great stocks to add to your own list, consider THE NEW MASTER RETIREMENT WATCHLIST.

NOTICE: The next International Online User Group Forum is set for Saturday, January 12 at 11:00 am EASTERN / 08:00 am PACIFIC. Learn about Bear Market Tactics and tips to survive and thrive during market volatility. Click here to REGISTER: http://news.vectorvest.com/CA_VectorVestForum_011219_registrationR.html

Good day: Re The Master Retirement Watchlist (My go to search!):

It is stated that “every Monday, adding the top 10 stocks from each to the Master Retirement WatchList……”). I assume then that for an ‘end of day’ subscription the new list will be available at the EOD Monday?

If a stock has been dropped from a previous week (ie it is not present in the updated list on a following week) is it still a retirement stock candidate or should it be dropped as well from my own (copy and paste) retirement watchlist?

Thanks in advance.

Hi Gary, the data is refreshed Monday evening so once that happens, yes, you will see a new list of stocks. Often there are not too many changes because these are good stocks that keep showing up in the searches, but well worth checking each week. Thanks Gary.

Stan, I have VV US. Where do i find the Master Watchlist?

Hi SR…..the New Master Retirement WatchList is only in the Canada database unfortunately. The DRIP WatchLists in the Dividend Payers folder in the US database offers some really strong dividend growth stocks. I hope that helps SR.