VectorVest’s UniSearch is the most powerful, easiest to use stock selection tool that I’ve ever come across. Our subscribers love to create their own searches that meet the criteria they value the most. A great example of this is Hershey-110’s 3rd place winning entry in the October Hot Stock Picking Challenge (HSPC).

This individual created a unique bullish search in the US database centred around a company’s earnings growth rate (GRT) and the Delta operator. Delta calculates the percent change over a defined period using any parameter such as Price, EPS, Dividends, Relative Timing (RT) and GRT. For their prize-winning strategy, Hershey-110 only wanted to purchase stocks whose GRT had increased by more than 8.0% over the last 90 days. Therefore, they used the following search criteria:

Parameter = Stock GRT- (Growth Rate)

Operator = Delta

Value= 90day > 8.0%

Hershey-110 also created three search lines regarding price. The first was Stock Price – (Split Adjusted) = Stock Price – (Actual). This is very unusual, so it’s useful to think about what it accomplishes. It is basically a rule to prevent a low-priced stock being returned because it has what may be considered an artificially inflated price after a reverse stock split. A reverse stock split often signals a company in distress, so why not eliminate them?

The next two search lines created a minimum “actual” price at time of purchase, “Stock Price -(Actual) > 1”, and a maximum price, “Stock Price – (Split-Adjusted) <= 5”. What’s the significance of “Split-Adjusted” in the second criteria? Basically, split-adjusted refers to how historical stock prices are portrayed when a company has issued a stock split. Split-adjusted data displays price as if there had been no split in the shares, providing a more accurate representation of price history until the present day.

You may find it useful to know the three simple rules set out below for when to use “Price (Actual)” and when to use “Price – (Split-Adjusted)” in your searches. I suggest you copy and save these rules to a computer file as a reference or print them out and keep it close to your computer. I taped my copy inside the cover of Dr. DiLiddo’s little green book, “Stocks, Strategies and Common Sense”.

RULE #1. If the Operator is either Trending, Delta, Hi-Lo or ProTrader, you will use “Price – (Split Adjusted)” 100% of the time. Example: “Price- (Split Adjusted)” DELTA 10 day > 5.00%.

The Reason: When you compare price over a period of time, you must use split-adjusted pricing. This allows correct “historical” price comparison from point A to point B, regardless of any stock splits.

RULE #2. If the operator is >, <, = or ‘Near’, and there is a number in the value box, you will use ‘Price (Actual)’ 100% of the time. Example: Price (Actual) > 50.

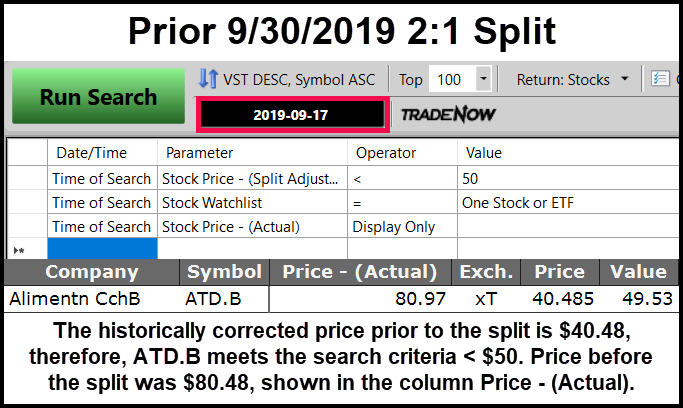

The Reason: No matter what date you run your search, if you want to find stocks that are above or below the historically correct price adjusted for any splits, you must use “Price – (Actual)”. For example, ATD.B split 2:1 on 09/30/2019. Price was $80.00 before the split, and $40.00 after the split. If I run a search with the criteria, “Stock Price – (Actual) > 80”, on a date prior to the split on 09/30/2019, ATD.B will be returned. However, if I am looking for stocks where the historically accurate price is less than $80, I would Use “Price – (Actual) < 80”. ATD.B would not be returned.

RULE #3. If you compare price to another price-based parameter such as Value, Stop, High, Low or Open, you will use ‘Price (Split Adjusted)’ 100% of the time. This is also true for SORT criteria used in VectorVest Fields or Custom Fields that you created. Search Example: Price – (Split-adjusted) > Value. SORT Example: Value / Price (Split-adjusted).

The Reason: Since Value and the other price-based criteria are all split-adjusted, you must use “Price (Split-Adjusted)” if you want to compare Price to those parameters. You must compare apples to apples. For example, if you searched for “Price (Actual) > Value”, then you are comparing an actual number to a split-adjusted number. This is incorrect.

Remember, if you have any questions about the above, make sure you’re doing the right thing by checking with our Support team at 1-888-658-7638. With very little time and practice, you’ll soon be able to HARNESS THE POWER OF UNISEARCH.

Leave A Comment