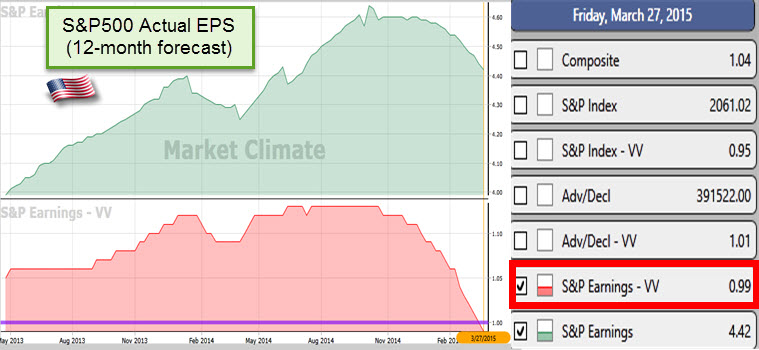

In case you missed it, the US market officially turned BEARISH on Friday. VectorVest’s Earnings Trend Indicator for the S&P500 forecasted EPS fell below 1.00 to 0.99 which triggered the signal. The Truth Chart tells us that the market is now in a Case 6 Bear Market Scenario in which earnings and inflation are trending lower while interest rates are trending higher.

In case you missed it, the US market officially turned BEARISH on Friday. VectorVest’s Earnings Trend Indicator for the S&P500 forecasted EPS fell below 1.00 to 0.99 which triggered the signal. The Truth Chart tells us that the market is now in a Case 6 Bear Market Scenario in which earnings and inflation are trending lower while interest rates are trending higher.

Lower earnings lead to lower stock valuations. However, Dr. DiLiddo said in Friday’s essay, “There is no need to panic over this Bear market signal. Earnings are still robust, although they are being pressured by the strong dollar and oil prices.” He went on to say that consumer savings from the lower oil prices should give the economy a boost sooner or later, and, ultimately increase earnings growth. Having said that, he concluded that investors should not be complacent. We need to protect capital.

Friday’s Special Presentation gave us 7 ways to protect our capital and even make money if the market continues Bearish. Please join me for tomorrow’s free SOTW Q&A webinar at 12:30 PM EDT. We’ll answer your questions about the 7 strategies, and we’ll also take a look at the following:

- what happened in the last two lengthy Case 6 market conditions

- what timing signals do we need to pay particular attention too

- what sectors performed the worst in the 2008 Case 6 Bear market and which one’s performed the best

- Is Canada heading for a Bear market signal anytime soon?

To register for our free webinar, please click on the following link: http://news.vectorvest.com/CA_SOTW_QA_033015_registration.html

We’ll also study leading stocks and perhaps a better graph set-up for aggressive investors who want to get in a gold/silver stock even earlier at the beginning of a potential breakout.

Here’s the Market Climate Graph showing S&P500 Actual Earnings and VectorVest earnings:

The Futures say Yes – VectorVest says No – it’s tempting to at least tip-toe back in to the markets this morning – particularly the U.S., but …

See you in a bit Stan, your insight never comes too soon

Hi Barry, these markets can change quickly and experienced, aggressive investors may wish to take advantage of that volatility. VectorVest provides guidance that it’s usually best to wait for at least the PW/Up to buy stocks long, even for aggressive investors. We had that for awhile today in Canada. I don’t believe we got it in the US today but I may not have noticed as I had other commitments after my SOTW webinar this morning (MDT). Always comes down to a personal choice, experience and investment style.