By Don Fanstone, Member, Kitchener/Waterloo User Group

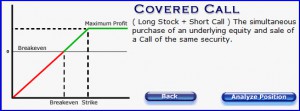

Selling Covered Calls for Income:

Selling Covered Calls for Income:

Selling Covered Calls can often create a great deal of angst when the underlying stock goes up in price and the Call option goes up in price in tandem. The seller of the Covered Call feels that they’re “missing out” on the stock price increase. They may have made a wrong decision by selling the Covered Call, but rebuying the Call Option prior to expiry soon eats up any gains due to trading expenses and the increased cost of rebuying the Covered Call.

When a decision has been made to sell a Covered Call, it’s best to let the trade expire without buying the call option back before the date of expiry.

When selling Covered Calls for Income, sell one month out and one strike out of the money, preferably on a stock with high volatility. The higher the volatility the higher the Option Premium.

With the market being “beaten down”, there are a number of quality stocks that offer attractive one month returns.

e.g. Linamar – Current Price $70.33

A November $72 Call Option can be sold for $2.70. If not called by the third Thursday in November, the return is 3.83% Annualized 46%

If called; the return is $2.70 (Option Premium) plus $1.67 (Difference between Stock Price and Strike Price) for a return of $4.37 or 6.22%. Annualized 74.5%.

Considerations?

Linamar reports earnings approximately Nov. 5th. A choice to sell now or wait on a possible favourable earnings report.

If a Covered Call is sold now, it protects on the downside, but may limit the potential upside of a good earnings report. (A bird in the hand is worth two in the bush!)

The ideal time to sell covered calls is when the DPO is at a high. (11/11/2014, 02/13/2015/ and 06/03/2015)

Gold and Mining shares are offering very high volatilities and attractive Covered Call returns. See ABX, ELD, FM, TCK.B.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Excellent Post. Nice to benefit from your wisdom again:)

What is covered call if I understood properly is it buy the stock and put sell order some time .Am I right

Hi Dan- Thanks for your Covered Call Post- “I LOVE COVERED CALLS ” it is a great souse of income There is always the danger of being assigned and losing my stock -What I do to Off Set that is I run 50% of my position as Covered Call -The remaining 50% as Not Covered -It helps me knowing that I can have it both ways

Unfortunately, at least at BMO Investorline, if the stock is called away, the commission charged is ~$30, instead of the online commission of ~$10, plus some other Option Fees. So, you have to have a large position in order for the fees to not reduce your profit too much.

If the Options expire worthless, then no problem.

There is a very good ebook available on Amazon by Steven Place. It is Covered Call Trading: Strategies for Smart Investing Profits. In it he advocates watching the Delta of your stock. If the delta is above 90 you have pretty much realized the maximum profit and you should roll it over to a lower delta stock If the time to expiration is greater than 2 weeks roll it to an option with the same expiration but with a 50 delta. If the time is less than 2 weeks roll it to a to the next period, again with delta around 50. He advocates a similar strategy when the delta drops below 20, rolling down. I am just starting to work with these strategies. Covered Calls work best when the stock is moving sideways, these strategies help when the stock goes up or down by substantial amounts

error: that should have been lower delta option, not lower delta stock in the second sentence

Hi Bob:

A good suggestion for all investors to consider. Have you gone back and looked at your trades with and without covered calls and determined if you are further ahead by following this program. Stated in another manner, would the covered call income on all of your shares be less, equal to, or greater than the capital gains you have realized, or have you left some money on the table, or are you further ahead following the 50/50 program?

Thanks for your suggestion Bob.

Don

Hi Don

Sorry for the delayed reply

No I have not looked back nor have done any amount of analysis I try to KIS When I set the trade there is always Cap Gain built in so the premium is a bonus – I liken it to a forced dividend

I am always amazed at some Traders who invest in a stock for Dividend purposes and will wait 3 months for a .75 dividend — when on some stocks we can receive .75 in one month with Cov. Calls

are there times when it does not work ?– sure but I can assure you those trade are in the minority

I have done Cov. Calls with USA stocks “Weeklies” with some success – have you done CC with weeklies ?-and what are your thoughts on that method- Thanks

Bob

Hey Don,

What a great article. I love covered calls and try to take advantage of them whenever I can. I sold some today on MG and a day or two ago on DOL. I like to think of them as supercharged dividends for income. Since starting to use them I have tried different ways of doing it i.e. different strikes and expiry dates. I finally settled on one month to take advantage of time decay and one strike out exactly as you recommend. Six weeks maximum. I also learned that the most volatile stocks pay the best but also that the volatility can change from month to month. As one example, a couple of times I got an amazing premium for AAPL calls but then after the stock dropped they paid peanuts when I went to sell more. One thing in your posting that really caught my eye was the word “angst”. I can really identify with that. Several times I bought back calls and felt like I had just messed up the trade. The last time was when I sold calls on DOL not realizing it was days before earnings. The stock shot up and it cost me a lot to buy the calls back while constantly watching the price, hoping for a pullback and feeling worse and worse as the stock kept going up and showing no signs of reversing. In the end I roled them out and still made some money but the whole experience was stressful for a couple of weeks, something I don’t need. I finally decided I will now just let the trade take its course and just think of it the way I would think of a buy-write. They can take away the stock in a month and I will just buy it back and sell calls again. I calculate the % return for the month, multiply by 12 and think “where else can I make income like that so easily?”

I Don

I love your articles. However, if a stock is performing well I do buy back call and re-write hem at a more distant month and perhaps a higher strike. Depending on your broker, doing so may not increase trading costs. I deal with TD and stock purchase is 9.99 buying or selling an option contract is 11.24 and exercise fees are $43. So, buying back a contract and selling a new one costs less ($22.48) than letting a contract be exercised then buying a new stock and selling a call (43+9.99+11.24=64.23). The key question is whether the stock prospects for the next contract period are still good.

Brian

While managing options is a pretty low maintenance endeavor, as Brian points out you want to avoid having your stock called away because among other things the cost of the commissions. If you have a number of covered calls going at once, its easy to slip up on closing out the contracts when warranted.

Here’s a technique I use. I use Vectorvest’s portfolio manager to create an artificial portfolio for the month, say “calls Nov”. Then for each contract I have, I make an entry in the portfolio as though I had sold short the number of shares controlled by the option using the strike price as the sale price. For example if I had 2 November 54 calls open for TD I will add a trade to the portfolio of 200 shares short at a cost of $54. I do this for each option I have open for November. Now when you look at the portfolio each evening, any calls that might require action are shown in red as losing trades in the same way you use the color guard to check the climate of the market. For those calls appearing in red check to see if they have any ex-dividend dates coming up so that you are not unpleasantly surprise by having your stock called away. On the last day of the option’s life you need to decide what to do about any options appearing as losses, anything green is okay on the expiration day.

A variant on this which I’ve just begun using is to create another dummy portfolio selling the stock short at the strike price plus the premium. This will show in read when the stock price is above the strike plus the premium. Before expiration day this value is less than the best possible outcome, but it is something to be alerted about. Also, if the red figure is very large, you have already made about as much money on the trade as you can and you may decide to take some action.