GIB.A: CGI Grp A: Holding Aug. 40’s. Stock is moving up strongly, May be late in this cycle to make a purchase. Much going on in this company, highly recommended.

GIB.A: CGI Grp A: Holding Aug. 40’s. Stock is moving up strongly, May be late in this cycle to make a purchase. Much going on in this company, highly recommended.

CNR: Can Nat’l Rlwy: Sold 10 June 66’s Feb. 6th. Bought Jan. 14/15 @ $13.60, Sold Feb 6th @ $21.75. Holding Sept. 72’s, June 70’s and June 72’s. Can add anytime.

ACQ – AutoCanada: No Options Speculative Holding Shares

IPL: Inter PipeLine Holding July 27’s and Shares. Currently in a downtrend. Good MDP Yld. 4.5% Support @$31.73 and $29.91

AC: Air Canada: No Options Holding Shares. Low Fuel Costs, Added Baggage Fees, Hi Load Factor

GWO: Great WestLife: Holding July 28’s Earnings Feb 12. Resistance @ $33.93. If stock closes above this value, Buy. If not Sell.

ENB: Enbridge: Holding July 52’s. Under pressure as IPL. I believe the pipelines will recover strongly.

AVO: Avigilon: Holding July 14’s. Moving up steadily Earnings March 3. Buy now and sell on March 2nd or gamble and hold.

RY: Royal Bank: Holding July 64’s Purchased prematurely. DPO currently negative. Buy when DPO positive. Did not follow the Trading Plan!

STN: Stantec: Holding July 27’s bought Feb. 6th and Apr. 32’s Earnings Feb 26. Buy on a strong earnings report.

BAM.A: Brkfld Asst Mgmt. Holding July 56’s.Rising Steadily, New Hi today.

HCG: Home Capital Group: Bought July 38’s on Feb. 6th. Closed down sharply today. Caution. Earnings Feb 11th.

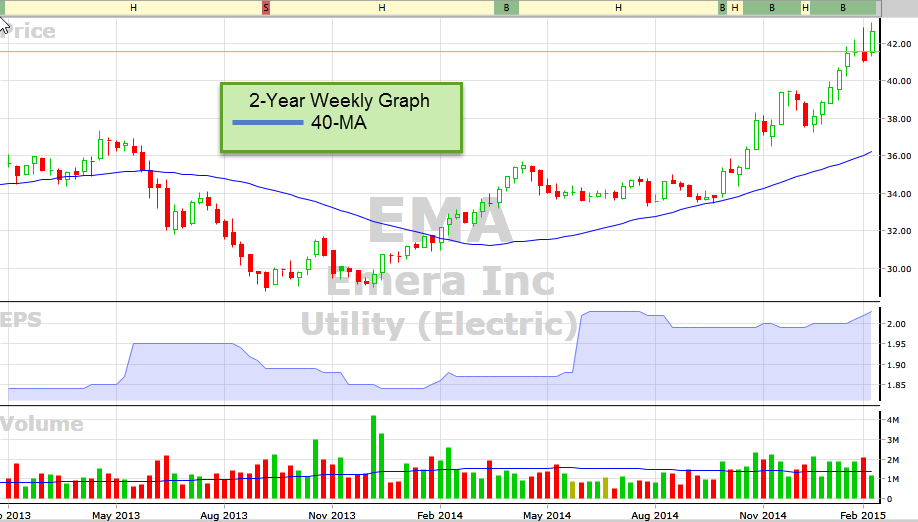

EMA: Emera: Bought August 34’s today at $8.95. This is a $.30 premium over the stock price. Excellent Entry. Steady rising stock.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Thank you for sharing your thoughts with us. Your insights are very much appreciated.

Thanks Mike, if you have any questions, I’ll do my best to provide an answer.