By Don Fanstone, Member, Kitchener/Waterloo User Group

VectorVest advises buying undervalued High VST stocks in a rising market.

VectorVest will help you make money if you follow VectorVest timing advice.

USA: Col. Guard Bearish, MTI .96, Dn/Dn, C/Up, Do Not Purchase

Canadian: Col. Guard: MTI .85 Dn/Dn, C/Down Do Not Purchase

With both markets falling, a good time to stand aside, cut losses or take profits.

Sells for the Week of May 27:

5 Magna (MG) Nov. 58 Call Options @ $14.60 Profit $1,975

10 Emera (EMA) Aug 34 Call Options @ $7.05 Loss $1,900

1000 Shares Air Canada Profit $2,325

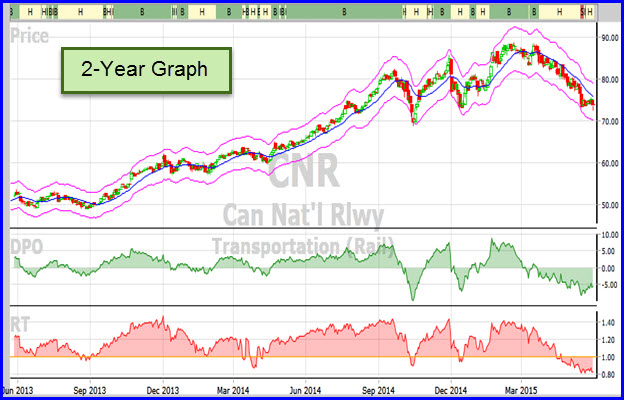

10 CNR Sept. 72 Call Options. A Loss**

CNR was a big winner in 2014. In 2015, my faith in the Company was reinforced by a good earnings report on April 20 and a 25% dividend increase. While the stock was falling, my confidence in the stock was not rewarded. The economy is contracting, oil is expensive to ship at lower prices, and Teck Mines have shuttered their coal mines for 6 weeks due to an oversupply; all negative for railroads. On Thursday, a bridge collapsed while a CN train was crossing. While I am ahead overall on CNR, once again, I made the error of falling in love with the company and not following technical guidelines. CNR is now on a watchlist for an eventual turnaround. At this time, Puts are a consideration.

Buys for the Week of May 27:

15 Air Canada (AC) Oct. 10 Call Options @$3.50

When Air Canada shares were purchased, there were no options being traded. This week, I noticed that this had changed, hence the change from shares to options.

Education:

The VectorVest Basic Options course is available online.

I attended the VectorVest Intermediate Options course for a second time in Mississauga and met a considerable number of like-minded traders.

Stan Heller, our Canadian VectorVest Rep would appreciate your input by writing articles for the blog. If you’re ready to share your trading experiences, contact Stan at [email protected]

There are numerous strategies with options, mainly limited to marginable accounts.

In TFSA’s and RRIF’s, one is only allowed to:

Buy Call Options

Buy Put Options

Sell Covered Call Options.

This eliminates many recommended option spreads in RIFF’s and TFSA’s.

The Option Course supplied the attendees with “The Option Playbook” by Brian Overby. (Much reading ahead.)

Also covered at the Options Course was the new VectorVest Options Pro. This is an amazing platform for the active options trader. Talk to VectorVest to learn more. Trials are available.

The Montreal Options Website has a significant amount of information for those seeking to learn more about Options.

Visit www.m-x.ca

Look under the heading Education:

- Option Examples

- Option Blog Articles:

- Optimizing Your Covered Call Strategy by Richard Croft

- Strategies for Income Investors Seeking Yield by Richard Croft

- Excellent Blog Posts by Patrick Ceresna and Jason Ayres.

I encourage all to read Lee Lowell’s book “Get Rich with Options”.

Understand Options Before you begin to trade, there is much to learn.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Excellent info. Thx for sharing

Hi Mike:

Thx for your comment. If you have any insights on CNR, they would be appreciated. It will change at some future point. I have it on a watch-list for when the Price crosses above the 30 DMA and the DPO turns positive.

Don

It’s going to be ending of mine day, however before finish I am reading

this great post to increase my knowledge.