By Don Fanstone, Member, Kitchener/Waterloo User Group

VectorVest advises buying undervalued Hi VST stocks in a rising market.

VectorVest will help you make money if you follow VectorVest timing advice.

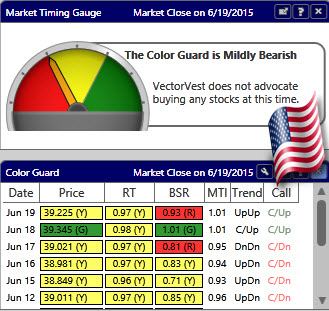

USA: Col. Guard Bearish, MTI 1.01, Up/Up, C/Up, VV: Do Not Purchase.

CAN: Col. Guard Bearish: MTI .74 Dn/Dn, C/Dn VV: Do Not Purchase

The US market recorded a Confirmed Up on Thursday June 18.

Sells for the Week of June 15th:

Nil

Buys for the Week of June 15th:

5 Skyworks (SWKS) Aug. 100’s @ $14.30

5 Hudson’s’ Bay (HBC) Oct. 23 @ $4.70

Stocks to Watch:

CNR: Huge volume Friday, Price > 30 DMA, DPO Positive. Potential Buy Dec. 64

ATD.B has risen to a new high. Would be a BUY if the market was in an UP/UP condition. Add at your own risk. Potential BUY November 44 Call

DOL. The VV graph on DOL shows a low EPS report outlook, and a low value. The Stochastics are at a high at this time. I would hold off on buying DOL at this time.

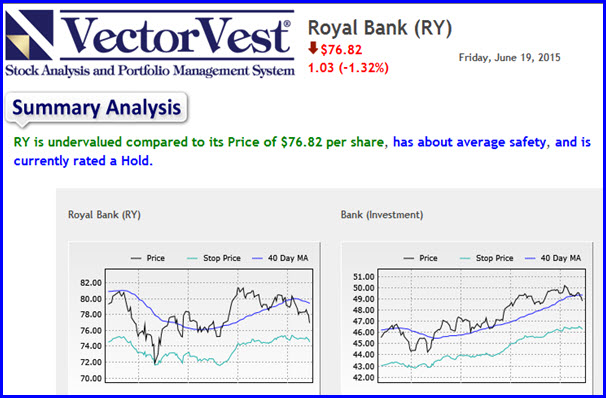

RY: Royal Bank continues to fall. Support at $75.16. Potential Buy on Reversal at support and a market moving up. Jan. 66 Call. *SEE VECTORVEST STOCK ANALYSIS REPORT BELOW.

With the market in a Down Condition, if these Options are purchased, it would be prudent to consider Buying the same strike price, at another 3 months out. Buying Time is good insurance, giving the stocks time to move up.

Stan Heller, our Canadian VV Rep would appreciate your input by writing articles for the blog. If you’re ready to share your trading experiences, contact Stan at [email protected]

Understand Options Before you begin to trade, there is much to learn.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Leave A Comment