HP (HPQ) fell nearly 3% in pre-market trading Monday morning before settling at around a 1% loss when the market opened. The stock is suffering from news of billionaire investor Warren Buffet selling off his shares of the PC maker in the last week.

The SEC filing shows a sale by Berkshire Hathaway of 4.8 million shares valued at $130 million. This adds to a sale earlier this month on September 13 when Buffet offloaded an initial 5.5 million shares valued at $160 million. The two sales combine to more than 11% of Buffet’s stake in HP.

Warren Buffet began purchasing shares of HP last spring – leading to a surge in share prices or “the Buffet effect” as it is better known. But the stock has been on a downward spiral since April of 2022, losing more than 35% in that timeframe.

HP isn’t the only company to get cut from the roster as Berkshire Hathaway has trimmed its portfolio over the past 3 months. The company has cashed out a total of $33 billion over the past 3 quarters.

The investment firm has also slowed the pace at which it buys new shares, suggesting it is stockpiling cash for something big. Berkshire Hathaway reached a record cash on hand of $147 billion last quarter.

Getting back to HP itself, we know that the company isn’t optimistic about its path ahead. The company recently dropped its full-year profit forecast to a range of just $3.30 to $3.35 per share – 15 cents lower than previously anticipated. This was accompanied by a 10% decline in revenue.

HP has been struggling with weakness in China’s consumer market along with conservative IT spending plans stifling growth. CEO Enrique Lores says that they had to readjust expectations upon further review of the external environment in which the company operates.

So, should you follow Warren Buffet’s suit and sell off any shares you have of HPQ? We’ve taken a look through the VectorVest stock analysis software and have found 3 things to help you make your next move one way or the other.

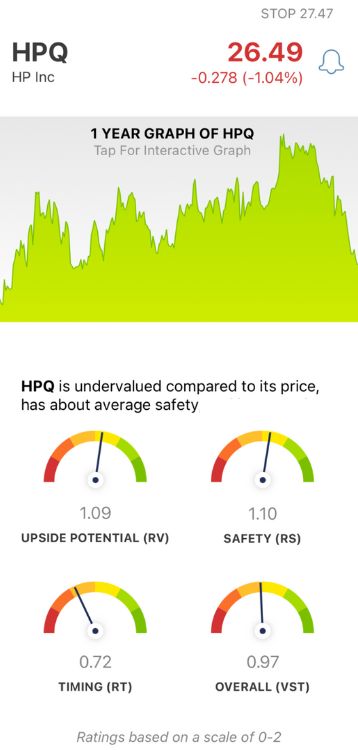

HPQ Has Fair Upside Potential and Good Safety, But Poor Timing Holding the Stock Back

VectorVest simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it - all based on three ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. But it gets even easier, as the system issues a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for HPQ:

- Fair Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (forecasted 3 years ahead) and AAA corporate bond rates & risk. Right now HPQ has a fair RV rating of 1.09. The stock is undervalued right now with a current value of $34.51.

- Good Safety: The RS rating is an indicator of risk and comes from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. The RS rating of 1.10 is considered good for HPQ.

- Poor Timing: The biggest issue for HPQ right now is the negative price trend that has gripped the stock for some time. The RT rating of 0.72 is poor. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.97 is slightly below the average, but deemed fair nonetheless. So what does this mean for investors? Should you buy, sell, or hold this stock right now?

A clear answer on your next move is just a click away at VectorVest. Get a free stock analysis today and eliminate guesswork and emotion from your decision-making for good!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Shares of HPQ are tumbling lower after news of yet another sell-off by Warren Buffet and Berkshire Hathaway. The stock currently has fair upside potential and good safety, but poor timing holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment