FedEx (FDX) reported fiscal 4th quarter earnings on Tuesday, and while there were some positive highlights, much of the report was negative. As a result, shares fell more than 5% in extended trading.

This was the company’s third consecutive quarter in a row of declining revenue, as sales fell more than 10% to just $21.93 billion. The guidance for the quarter was $22.55 billion. And unfortunately for FedEx and its investors, it doesn’t appear to be getting a whole lot better anytime soon – as the guidance laid out is low single-digit growth.

Making matters worse, the CFO at FedEx is set to retire at the end of July. This will be a big hole to fill, and it’s undoubtedly cause for concern. David Dietze of Peapack Private Wealth Management says this could be attributed to the major restructuring going on within the company, but at any rate, it’s rarely a good thing when such a pivot role retires.

That being said, there are some positive takeaways from the earnings report. The company reported a profit of $1.54 billion, a dramatic improvement from the year before. And, the adjusted earnings per share of $4.94 beat Wall Street’s expectations. Much of this comes as the company cut costs by reducing flights and grounding aircraft.

Fedex has projected EPS of somewhere between $16.50 and $18.50 for the year ahead – while the consensus was $18.33. FedEx will have to come in at the high end of their projection to keep Wall Street content.

While the initial reaction to this news was understandably negative, FedEx investors have to be satisfied with the stock’s performance so far this year. FDX is up more than 33%, while the S&P 500 has only climbed 13%.

Now, if you’re currently invested in FDX, what does all this mean for you – is this a good time to take your profits and run? Or, is there more to come? We’ve analyzed the stock through the VectorVest stock forecasting software, and we have 3 things we want to show you before you do anything else.

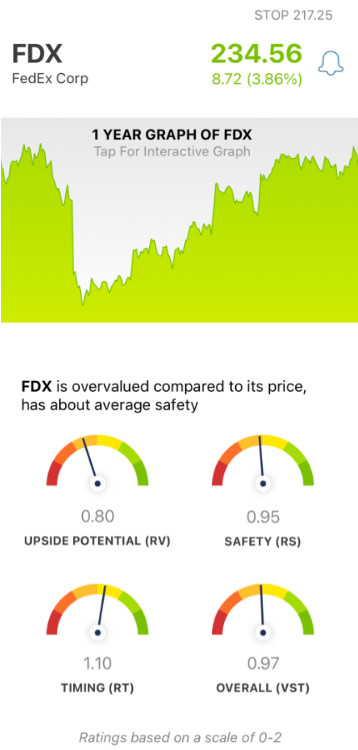

Despite Poor Upside Potential, FDX Has Fair Safety and Good Timing

The VectorVest system is based on a proprietary stock rating system that seeks to simplify your approach to analysis, giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00, with 1.00 being the average. By picking stocks with ratings appreciating above the average, you can win more trades with less work.

Or, better yet, eliminate all guesswork, emotion, and uncertainty by simply following the buy, sell, or hold recommendation the system offers for any given stock, at any given time. As for FDX, here’s what you need to know:

- Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (projected 3 years out) and corporate bond rates & risk. And right now, the RV rating of 0.80 is considered poor for FDX. Making matters worse, the stock is overvalued - with a current value of just $171.56.

- Fair Safety: An indicator of risk, the RS rating analyzes a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for FDX, the RS rating of 0.95 is deemed fair - albeit slightly below the average.

- Good Timing: The one positive thing FDX has going for it right now is a positive price trend - which, admittedly, has been weakened by the recent news. Still, the RT rating of 1.10 is good. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.97 is fair for FDX - but, it is just below the average of 1.00. So, what does that mean for current investors or potential traders? Should you close your position, add more shares, or hold off on doing anything for now? Get a clear answer on your next move with a free stock analysis at VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for FDX, the stock has good timing and fair safety - but the upside potential is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment