RANKING THE CANADIAN BANKS

Written by: Stan Heller

Canadian investors love their bank stocks, and why not? Few companies offer such a desirable combination of stability, dividends and growth. If you only have room in your portfolio for just one bank, which one would you choose? VectorVest analysis can guide you in your decision.

Even though you are a long-term investor, it’s always better to get off to a good start. Therefore, you want to get in when the market, the industry and the stock are rising. You may also want to avoid unnecessary risk by not buying in too close to earnings. So, you need to know the upcoming earnings dates. You can check them out in VectorVest’s Events Viewer, but also double-check with your broker in case of any late changes.

The Events Viewer shows the Canadian Imperial Bank of Commerce (TSX: CM) starts earnings season for the banks next Friday, February 24th. Bank of Montreal (TSX: BMO) and the Bank of Nova Scotia (TSX: BNS) are next on Tuesday, February 28th, followed by the Royal Bank (TSX: RY) and National Bank (TSX: NA) on Wednesday, March 1st. Toronto Dominion Bank (TSX: TD) reports last on Thursday, March 2nd.

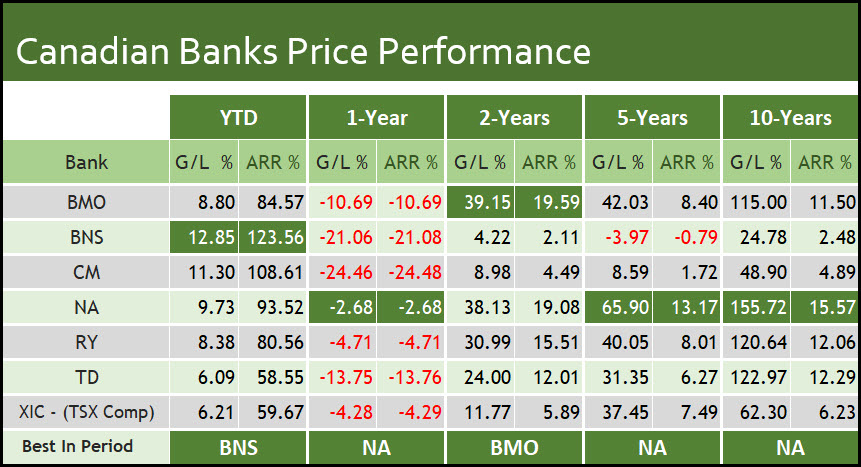

We will use VectorVest to study past price performance and key financial metrics, including Value, Safety, Timing and Dividends, to help us determine the best candidate. First, let’s look at the raw price performance to February 10, 2023 over 10 years, 5 years, 2 years and YTD. VectorVest’s QuickTest tool makes the comparison quick and easy. The QuickTest does not include dividend payments.

National Bank is the clear winner for overall consistency. Especially important for long-term investors, NA was the clear winner in the crucial long-term 5-year and 10-year results. It also fared better than the other banks in the 1-Year QuickTest, which included most of 2022, a prolonged bear market in which BNS and CM plunged more than 20%. NA was the only bank in the 1-Year lookback that beat the TSX Capped Composite Index represented by XIC, the iShares ETF.

Touted by many analysts and fund managers as Canada’s top bank, TD was second in the 10-year category but lost -13.75% in the 1-Year category. It is also off to the weakest start among the banks in 2023 with a 6.09% gain YTD.

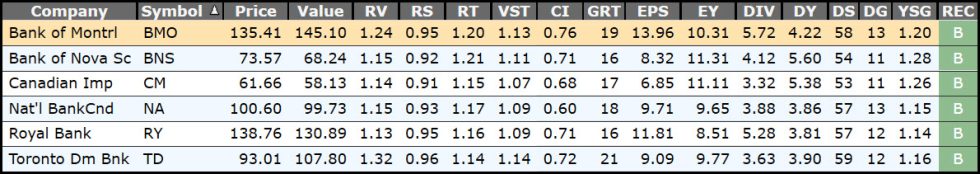

We turn to VectorVest’s Stock Viewer to analyze key financial metrics as of February 10, 2023

All six banks are relatively close in this competitive analysis. BMO and TD are undervalued, while the others are mainly fairly valued. Importantly, TD has the highest Relative Value (RV) an indicator of medium to long-term upside potential. It also has the highest forecasted earnings growth rate, GRT, at 21%. All six banks have slightly less than average Relative Safety (RS), while short-term timing shows strength with RT values well above 1.0. All six banks are rated a ‘B’ or Buy. CI stands for Comfort Index, a medium to long-term price consistency and resiliency measure. Perhaps not surprisingly, all the CI scores are rated as “Poor” after the banks got whacked in 2022.

All current dividend yields are attractive, with BNS and CM the leaders with 5% plus. The Dividend Safety ratings on a 0-99 scale are all above average but not as high as you might expect for Canada’s big banks. The Dividend Growth rates are well above inflation and interest rates, a positive for the banks.

THE WINNER. National Bank is my choice, largely because of its consistently good price performance and earnings growth. One thing is clear, VectorVest gives us the tools we need when RANKING THE CANADIAN BANKS.

Leave A Comment