By Don Fanstone, Kitchener/Waterloo User Group Member

Trade Analysis:

We all learn from our mistakes, if we don’t we’ll keep making the same mistake until we learn the lesson.

Performing a good Trade Analysis when an Option/Stock Trade is closed is the best way to improve your trading percentage.

Why you entered the trade?

Was it a good decision?

Should you have taken action (Sold the position or added to the position) that you thought about but didn’t act on?

Where was the MTI during the trade?

What signals helped you during the trade? Stochastics, Moving Averages, Detrended Price Oscillator, VV Buy, Hold or Sell signals or other considerations.

Keeping a “Trade Journal” filled out weekly keeps you focused on the situation at hand.

Sells for the Week of April 20:

10 RY July 15 Calls: Buy Jan. 23 @ $12.75, Sold April 20 @ $17.15 Profit $4,400

Buys for the Week of April 20:

April 20: 10 DEPO (Depomed) Aug. 20 Calls @ $7.50 US

April 24: 5 KR (Kroger) Aug 60 Calls @$12.70 US

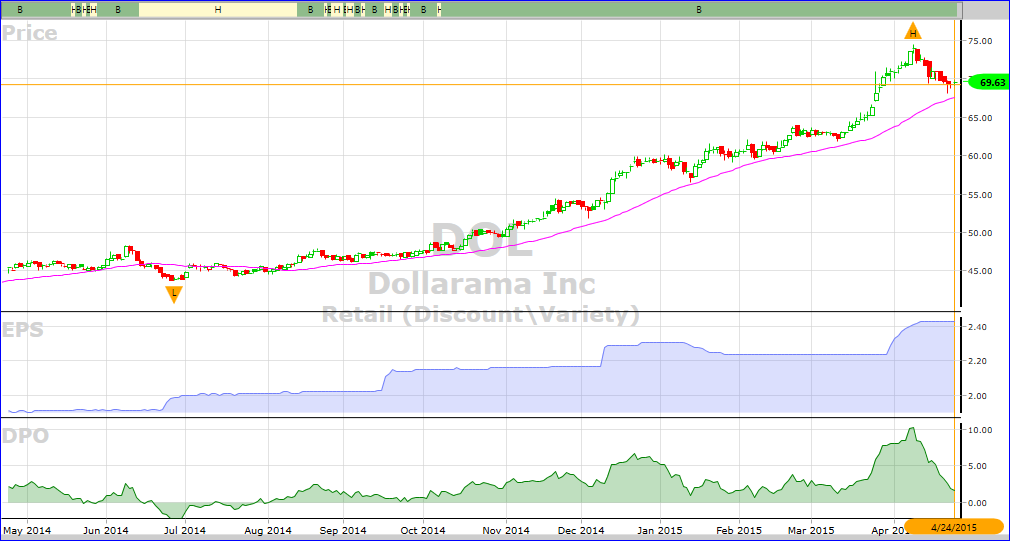

CGI, DH, CTC.A, and DOL are good long term option candidates.

I encourage all to read Lee Lowell’s book “Get Rich with Options”, go to VV University and watch the Video on Options, and read Dr. DiLiddo’s article in the Views Manager under Special Reports, and attend the VV Options Course.

Understand Options Before you begin to trade, there is much to learn.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

HI Don

Am I missing something here? I am looking at the KR and DEPO calls and I don’t see any for Aug!!??

Geoff

Geoff:

You’re not missing anything, that should read September.

Don

OK Thanks Don

Geoff